Filter Results

- Compounding

- Capital Allocation

- Culture

The Makina Blue Chip Thesis

Introduction The journey from private crypto investments to accessible, institutional-grade DeFi infrastructure has been long and fragmented. For years, sophisticated yield strategies were only available to accredited investors and had high minimum liquidity requirements. Retail participants settled for basic lending yields of 3-4% on platforms like Aave or much riskier and complex opportunities. Until now, the lack of high quality and accessible onchain strategies has limited DeFi’s long-term growth. As the first Operator on Makina, Dialectic has witnessed firsthand how this new execution … Continue reading

Yield farming SOK

Yield farming, a core mechanism within Decentralized Finance (DeFi), has rapidly evolved alongside the broader expansion of blockchain-based financial systems. Once a niche activity, it now plays a central role in capital allocation across DeFi protocols. However, the complexity and constant innovation in this space make it challenging to develop a clear understanding of its mechanics and associated risks. In this Systematization of Knowledge (SoK), we present a structured overview of the yield farming ecosystem and its vocabulary through three core dimensions: yield sources, yield quality, … Continue reading

Why Work at Dialectic?

As we celebrate our 5th anniversary, I thought it pertinent to consolidate our views on what makes working at Dialectic special. I often describe Dialectic as a compounding machine. But it isn’t just an on-chain machine for compounding capital. The core mechanisms in place are designed to allow great people to compound on their personal development and entrepreneurial skills, seek truth together, and build the Dialectic compounding machine as a cohesive, high-performance team. At this stage of our evolution, I observe 6 primary categories that make working at Dialectic quite unique: 1. We are … Continue reading

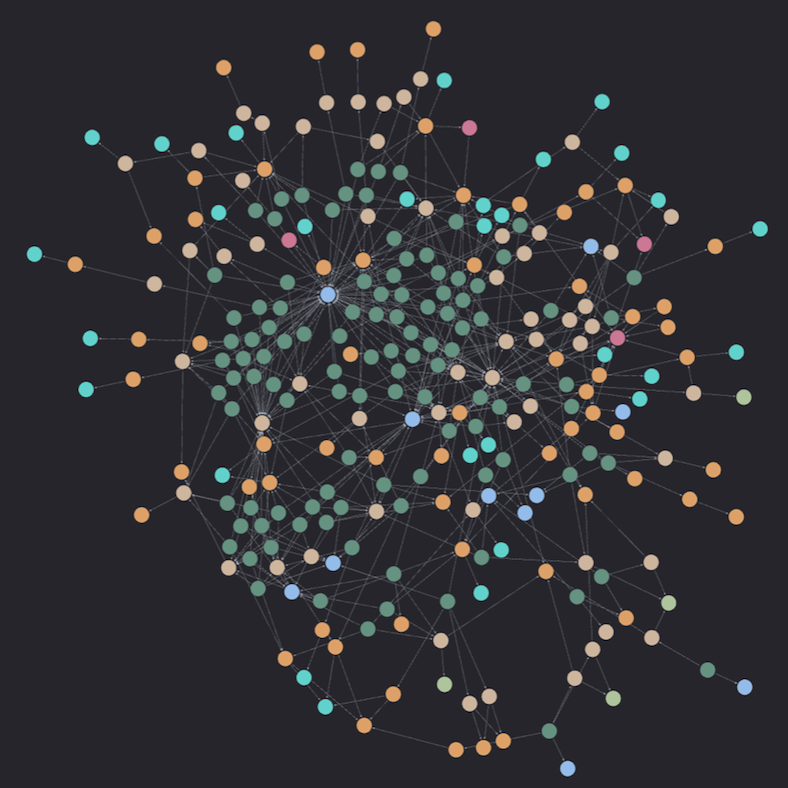

Nebula use case : Decomposition of Bizyugo’s portfolio

Nebula is a graph-based representation of DeFi, designed to model the composability nature of decentralised finance for risk assessment and navigation purposes. In this blogpost we propose to leverage the developed tool to decompose and analyse the yielding portfolio of a popular DeFi user, namely … Continue reading

Crypto Investing vs TradFi - Part I - Venture

Note: This is the first in a series of posts highlighting the differences between crypto-native investing and TradFi investing. Context As we forge forward into the 4th major cycle in the history of crypto, we’ll again see an influx of TradFi folks taking the trip down the crypto rabbit hole and … Continue reading

ReFi & The Social Power of Cryptoeconomics

What is ReFi? Regenerative Finance, or ReFi, is an emerging concept that aims to create positive societal impact alongside reasonable financial returns on risk-capital in order to bring ambitious social projects to life that couldn't exist on philanthropy alone but shouldn't be co-opted by profit maximization principles. ReFi seeks to be constructive capital to align economic incentives with positive environmental and social outcomes. Usually these models tend to blend non-profit organizations with for-profit corporations in some creative way. I discuss some of the experiments, lessons … Continue reading

Introducing Nebula : A graph based representation of DeFi

Glossary DeFi vocabulary is assumed to be known by the reader. - Knowledge graph: Structured representation of interconnected data stored as a graph. - NEO4J : Leading graph database management system. - Cypher : Querying language for NEO4J, designed for graph data manipulation. Introduction For … Continue reading

Benchmarks and performance attribution for DAO treasuries

Can we learn from investment performance evaluation in traditional finance to help DAOs make better decisions? Introduction The literature and practice for investment performance evaluation in traditional finance is extensive. However, the on-chain world has few proxies that could provide DAOs or … Continue reading

DeFi as a Necessary Primitive - Case Study: GLIF

DeFi is Surging Throughout Crypto 2023 will be remembered as the darkest winter imaginable in DeFi, especially in the wake of the Curve attack. However, Q4 observed a considerable uptick in capital inflows as well as yields. This uptik is being driven by improved primitives and the realization that … Continue reading

Chronograph: Institutional Grade Yield Farming

A day in a yield farmer’s life Running a delta-neutral or farming fund is a complex and risky activity, with exposure to numerous potential hazards, such as faulty smart contracts, counterparty blow-ups, and illiquidity. At Dialectic, we have been operating Chronograph, our fixed-income vehicle, … Continue reading

The Lore of Dialectic and Forgotten Runes

Prologue The Sun was reaching its high point in the sky over the mystical mountains of Zug. As per usual, the Dialectic Alpha Mancers were sipping their potions and excavating at the vanguard of the crypto rabbit hole as vape smoke filled the air. Suddenly one of the powerful Italian Alpha Mancers exclaims: “Pronto! I found it! Bellissima! Perhaps a gem has been uncovered.” They had stumbled across the Forgotten Runes Wizard Cult, a nascent idea of “Build to Earn”, where a community of like-minded Wizards would create the very world they wanted to inhabit online with magic, code and community … Continue reading

Thoughts on on-chain gaming

Special thanks to guiltgyoza , Ryan Zurrer , and Swagtimus for the feedback on this article. Also, thanks to Sylve and the MatchboxDAO 's community for the inspiration and thoughtful discussions. The gaming industry is slowly waking up to blockchain technology. It will dramatically change the … Continue reading

A Nouns Governance Attack Part 2

Huge thanks to the Nounder punk4156 and Ole for the insightful feedback. Blockchains are highly adversarial environments. On February 14th, the Build Finance DAO was targeted by a hostile takeover. A malicious actor was able to take control of the Build token contract and run away in profit by calling the minting function. At block 14169198 the attacker submitted a proposal, requesting the ownership of the Build Finance token contract to 0xDCc8A38A3a1f4eF4d0b4984dCBB31627D0952C28. On Build’s official discord, one of the developers alerted the community on what was going on and urged everyone … Continue reading

The Dialectic Reciprocity Pledge

Today, we announce the Dialectic Reciprocity Pledge, an annual tradition to allocate a significant portion of Dialectic’s fees from returns created by our portfolio of companies towards non-profit projects. We will direct these resources towards projects that are meaningful to our leading portfolio … Continue reading

Medici: Dialectic’s Yield Farmer

A look at Dialectic's Yield Farming operation and how we automated it. When we started Dialectic, we almost immediately looked into and decided to take advantage of stable incomes by way of DeFi yield farming programs. As the fund has continued to grow, so has the portfolio with which we farm. … Continue reading

A Nouns Governance Attack

In this post we analyze a hypothetical attack on Nouns, a generative non-fungible token (NFT) project mixed with a DAO on Ethereum. Nouns is a relatively simple but powerful idea, that can be credited with running an interesting new experiment in the NFT space. Every 24 hours, the Nouns Auction … Continue reading

Keepers Reboot — Observations & Forward Looking Trends

Keepers — the term to generally define the utility-layer actors on P2P networks who contribute key resources and behaviors in order to achieve a cryptoeconomic-Nash-equilibrium — are a fundamental building block and source of great potential for any crypto-network. See my previous post on Keepers … Continue reading

Keepers - Workers that Maintain Blockchain Networks

Cryptographic tokens, which can represent digital scarcity in various forms, are an amazing use-case of blockchain technology. Tokens can be used to incentivize desired behaviours in decentralized networks. When designed correctly, tokens can act like rocket-fuel for driving network effects. One … Continue reading