Yield farming SOK

Yield farming, a core mechanism within Decentralized Finance (DeFi), has rapidly evolved alongside the broader expansion of blockchain-based financial systems. Once a niche activity, it now plays a central role in capital allocation across DeFi protocols. However, the complexity and constant innovation in this space make it challenging to develop a clear understanding of its mechanics and associated risks.

In this Systematization of Knowledge (SoK), we present a structured overview of the yield farming ecosystem and its vocabulary through three core dimensions: yield sources, yield quality, and associated risks. This document aims to map the current DeFi landscape in which Dialectic operates, offering clarity and perspective on a rapidly evolving domain. Rather than delving deeply into each topic, our objective is to articulate and formalize the vocabulary we use internally, establishing a shared conceptual framework for navigating the space. We intend to curate and maintain this post as the DeFi landscape evolves, ensuring it remains a relevant and living reference.

Yield sources

Let us begin by outlining the primary sources of yield generated through DeFi activities. These represent the core strategies currently composing the Dialectic yielding books.

- AMM (Automated Market Maker): Facilitates decentralized trading by allowing users to provide full-range liquidity to token pairs, earning trading fees and, in some cases, protocol incentives. Examples: Uniswap v2, Curve.

- clAMM: Enables liquidity providers to allocate capital within a specific price range, significantly increasing capital efficiency. While returns are structurally similar to those of simple AMMs, primarily derived from trading fees, they require active management to optimize performance and mitigate impermanent loss. Examples: Uniswap v3, Aerodrome, Velodrome.

- Basis Trade: A delta-neutral strategy that captures the funding rate differential by shorting a perpetual futures contract while simultaneously taking a long position in the corresponding spot asset for the same notional amount. This structure allows for yield generation with minimal directional exposure. Examples: Ethena, or manually executed strategies.

- Bridge Passive Liquidity: Provides a buffer of liquidity to facilitate cross chain transfers in exchange for fees and incentives. Examples: Across, Hop, Connext V1.

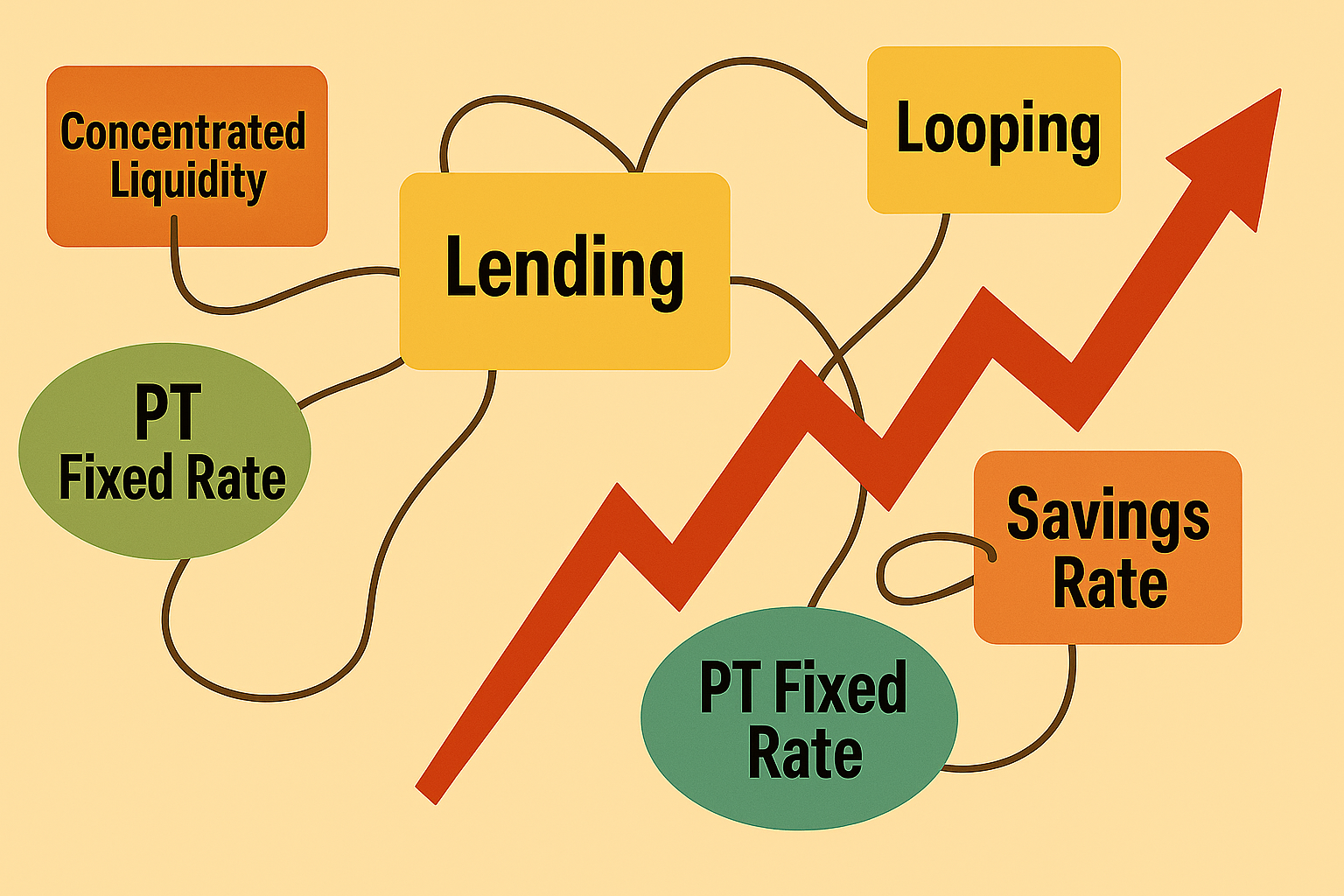

- Lending: Involves overcollateralized on-chain borrowing and lending, where users supply assets to earn interest while ensuring solvency through excess collateral. Examples: Aave, Morpho, Euler.

- NFT Lending: Facilitates lending markets where loans are overcollateralized by non-fungible tokens (NFTs), typically high-value or blue-chip assets. This emerging category introduces unique valuation and liquidation challenges. Example: Gondi.

- Looped Lending: A leveraged yield strategy that recursively supplies and borrows similar assets to amplify returns, profiting from the spread between supply and borrow rates.

- PT – Fixed Rate (Principal Token – Fixed Rate): Fixed-rate yield products structured by splitting the yield-bearing asset into principal and yield components. Users lock in a fixed return by purchasing the principal token, with the underlying yield sourced from existing protocols. Examples: Pendle, Spectra.

- Savings Rate: Low-risk or near risk-free yield derived from staking assets in protocols that passively distribute rewards, often backed by conservative underlying strategies such as tokenized treasury bills. Designed for capital preservation with minimal active management. Example: sDAI.

- Junior Tranche: The subordinate portion of a structured product that absorbs losses before senior tranches, in exchange for higher potential returns. Typically suited for risk-tolerant participants seeking enhanced yield. Example: Aave Umbrella.

- Perps Passive Liquidity: Capital is passively deployed to provide liquidity on perpetual futures exchanges, effectively taking the opposing side of traders’ aggregate PnL. This strategy can generate returns over time, particularly during periods of elevated volatility and frequent liquidations. Examples: Synthetix V3, Umami, GMX.

- Options Selling: A short-volatility strategy that involves selling call or put options in exchange for a premium. Examples: Cega, Ribbon.

- Crab Strategy: A delta-neutral, short-volatility options strategy designed to generate yield when an asset’s price stays within a defined range. Returns are maximized in low-volatility environments, while sharp directional moves can lead to losses. Example: Opyn.

Associated risks

Participating in DeFi comes with its own unique set of risks. Understanding these is essential for evaluating strategies and managing exposure effectively:

- Directional Exposure: The risk associated with holding unhedged or biased positions that are sensitive to market movements. Such exposure can lead to significant losses during adverse price swings.

- Smart Contracts: Faulty or vulnerable smart contracts can be exploited by malicious actors, exposing funds to risk in DeFi.

- Oracle Manipulation: Oracles are integral to many DeFi protocols. When a price oracle is manipulated, attackers can extract value from users. Example: Manipulating the USDC/WETH price oracle on Aave could result in fraudulent liquidations.

- Governance (Malicious or Compromised): Protocol governance entities that control smart contract logic may act maliciously or be compromised. This can lead to severe exploits. Example: The Radian exploit.

- Bridges: Liquidity on Layer 2s or other chains is often not native and relies on bridges for backing on the mainnet. If the bridge is attacked, assets may be at risk. Example: The Nomad Bridge hack.

- Operational Risk: Since DeFi is based on self-custody, poor wallet management or security (e.g., phishing or private key leaks) can lead to loss of funds. Example: Bybit hack.

Yield quality

Beyond capital risk, it is essential to assess the quality of yield. This includes evaluating the reliability, consistency, and sustainability of realizing projected returns.

- Paid in Kind: Returns are paid in the same numeraire as the allocated capital. Example: USDC lending on Aave where yield is paid in kind on a block-by-block basis.

- Liquid Tokens: Incentives are paid in existing liquid tokens. Example: Aerodrome DEX pays liquidity providers with the AERO token.

- Locked Tokens: Incentives are paid in tokens that are vested. Example: Euler pays with rEUL.

- Points: Returns are paid via points accumulation, representing a future amount of tokens. Points are the hardest category to assess, as they are challenging to price in terms of the underlying numeraire.