Keepers - Workers that Maintain Blockchain Networks

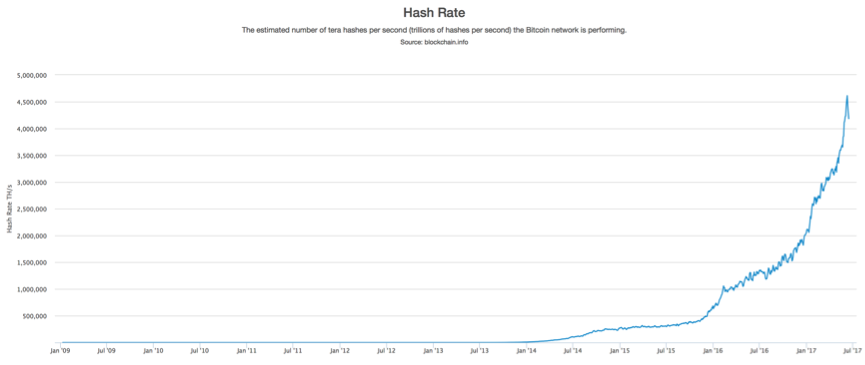

Cryptographic tokens, which can represent digital scarcity in various forms, are an amazing use-case of blockchain technology. Tokens can be used to incentivize desired behaviours in decentralized networks. When designed correctly, tokens can act like rocket-fuel for driving network effects. One early example is Bitcoin’s block reward, which has incentivized an astonishing amount of computational resources to be spent securing its blockchain, to the point where now Bitcoin is more than 100 times more powerful than Google (arguments regarding the marginal benefit to security aside).

Keepers

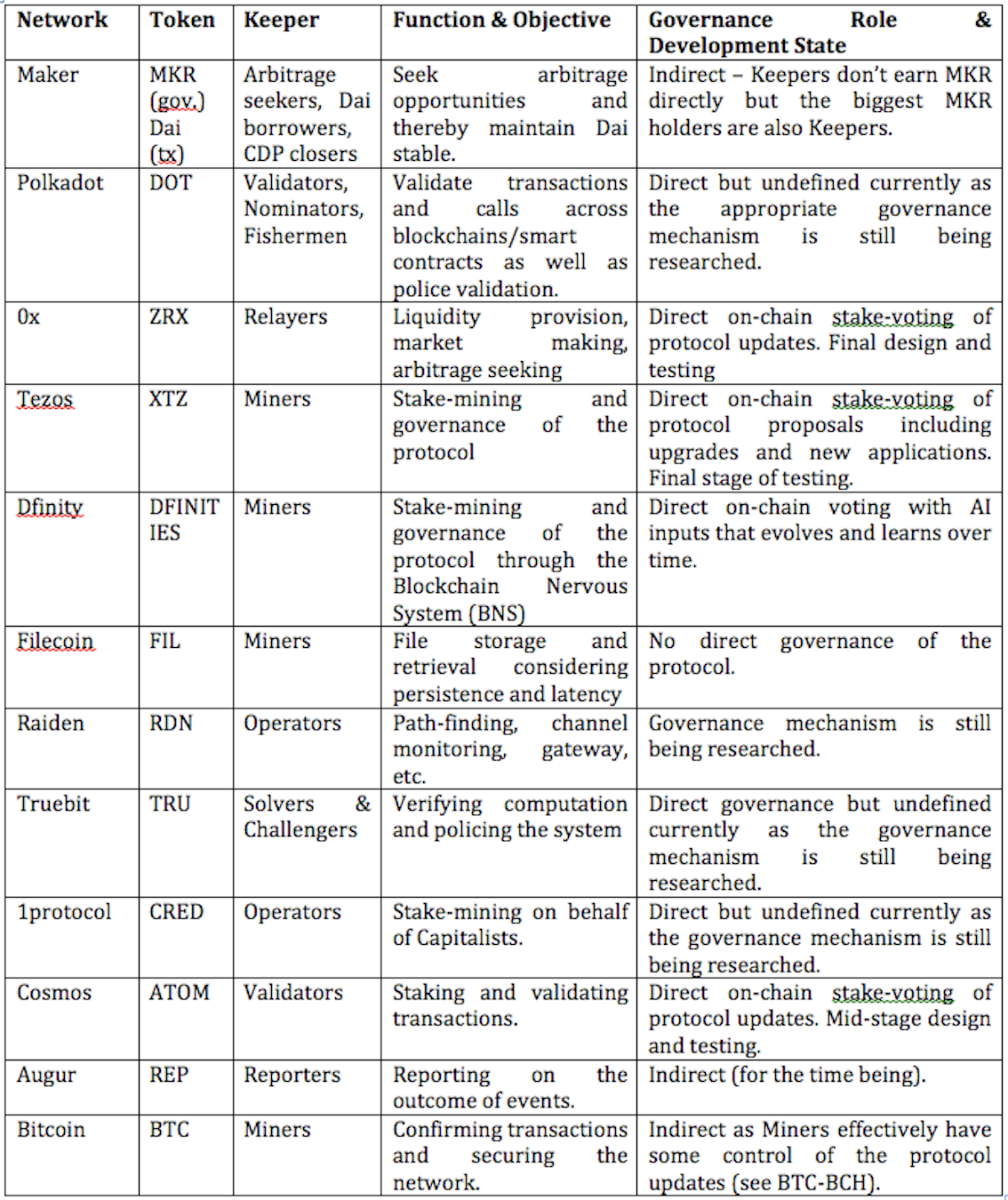

Bitcoin’s mining wasn't intended to be useful beyond securing the network. However, now we are seeing “work” done by network actors, which not only secures the network, but also add intrinsic value for the network. The utility layer of a blockchain network — which is a group of self-interested actors that maintain stability— seems to be naturally positioned to be compensated for their work in the native token and also a logical choice to have a significant voice in governance over the development of the given network. I call these network participants “Keepers” as a catchall term for the different utility players in distributed networks that maintain stability and perform crucial jobs in the crypto-economic model. You may notice this term from the Maker White Paper but below is a list of some examples of Keepers, including a) their function on each blockchain network and b) their governance role:

Governance Layer

On-chain governance mechanisms are mostly still under research and development as noted above. This is because on-chain governance is very difficult to solve securely (see The DAO) and thus many projects are utilizing simulated governance in the initial stages of network release. For example, Maker uses a participatory process whereby all of the major token holders are heard by the core team in weekly governance meetings. While final decisions currently rest with the core team, controversial issues are thoroughly debated before implementation and consensus is sought. This will change over time an eventually MKR holders will have direct voting rights. Alternatively, Tezos and subsequently Dfinity are large-scale implementations of on-chain governance whereby token holders will vote directly on upgrades to the protocol immediately from the Genesis block. Both are incredibly ambitious endeavours and we are excited to see the lessons learned, including whether distributed governance allows for dramatically faster technical evolution of the protocol, as proposed by these respective projects.

Remuneration Layer

By remunerating Keepers in a native token, a network is able to dramatically reduce the cost to users of that network, thereby accelerating network effects. Keepers are well positioned to be paid for their work in the native token. Since Keepers are naturally interested in the long-term stability and health of the network they operate on, they are more likely to be cautioned, long-term token holders, thus adding further stability to the network’s economics.

Categories of Keepers

As the idea of Keepers evolves, I suspect there will be a broad taxonomy of specifically defined categories of Keepers. Initially, I would cautiously propose 3 general classes (but invite feedback on categorization).

Implications and Further Considerations

Checks and balances: If the remuneration layer allows Keepers to consolidate the vast majority of the native token over time and the token has a governance function, it could be very dangerous for a network to be totally dominated by a single Keeper layer. For example, one could argue that miner domination in Bitcoin has detracted from the evolution of the protocol. Keepers may not act in the long-term interest of the network as a whole and may tend to favour their own ideas and desires over end-users, which could prove myopic. Thus, when possible, there should probably be more than one type of Keeper i.e. more than one layer of utility-actors so there is balance in the decision-making and operation of the network. It will be interesting to observe the dynamic that evolves between competing Keepers in some of the projects listed above. Another option would be remuneration of software developers directly. Promoting a robust developer community that earns tokens for their important contribution and maintains a healthy ‘voting bloc’ seems appropriate in nearly all cases.

Governance is valuable in and of itself: I hypothesize that if a token only served as a governance mechanism and had absolutely no other utility function, it could still have some value measured as a fraction of the total value of the network. Such a hypothetical token (that I am not recommending) may not have the considerable value that a token with a specific utility function would have. However, a governance-token could still potentially be quite important and valuable to network participants.

Massive market opportunity: Because tokenized incentivization acts like rocket-fuel for propelling network-effects, I believe we will see highly efficient and professional Keepers on blockchain networks very quickly. In a similar exponential function to the Bitcoin hash-rate graph above, we will see the deployment of massive capital pools behind extremely sophisticated algorithms seeking arbitrage, routing transactions, providing resources and driving security in decentralized networks. This implies that small-scale operations that intend to operate as Keepers will have a short life-span and entrepreneurs should be thinking about scaling bigger, faster. Many of the networks cited herein will spawn tremendous opportunity for sophisticated investors with deep technical skills.

It’s an incredibly exciting time as we move from the ideas that began with Gavin Wood’s vision for Web3 into implementing a number of compelling distributed networks that will reorganize intelligence (both human and machine) and capital in totally new ways. I am very grateful to be able to work with such amazing technologists and entrepreneurs on their crypto-economic models and I am constantly amazed with the innovative ideas being proposed by communities and academic researchers. I can’t wait to see how Keepers evolve and invite constructive feedback on the ideas shared herein.