ReFi & The Social Power of Cryptoeconomics

What is ReFi?

Regenerative Finance, or ReFi, is an emerging concept that aims to create positive societal impact alongside reasonable financial returns on risk-capital in order to bring ambitious social projects to life that couldn't exist on philanthropy alone but shouldn't be co-opted by profit maximization principles. ReFi seeks to be constructive capital to align economic incentives with positive environmental and social outcomes. Usually these models tend to blend non-profit organizations with for-profit corporations in some creative way. I discuss some of the experiments, lessons learned and opportunities moving forward herein.

ReFi Winter

There is a debatable narrative globally that Regenerative Financing doesn’t work and we shouldn’t attempt to innovate at the capital model layer of business. In the last year we’ve seen massive public failures of some prominent experiments in regenerative financing - most notably OpenAI, but also more recently with MAPS/Lykos and the Regenerative Financing Vine that I constructed. Does this mean ReFi is dead or are we just in ReFi winter and needing more innovation and experimentation in this area?

I note that in parallel, crypto has a perception problem. Politicians and TradFi executives often allege that crypto is a giant global grift and an unregulated casino of greedy self-interested shadowy super-coders. While we know that this is largely untrue and most of the space is made up of well-intentioned builders, as a community we need to come together and accelerate the examples of novel business models that program in reciprocity and public benefit directly into the raison d'etre of given projects, thereby using crypto primitives to programmatically unlock value for social good.

Types of Regenerative Financing

De-escalating royalty

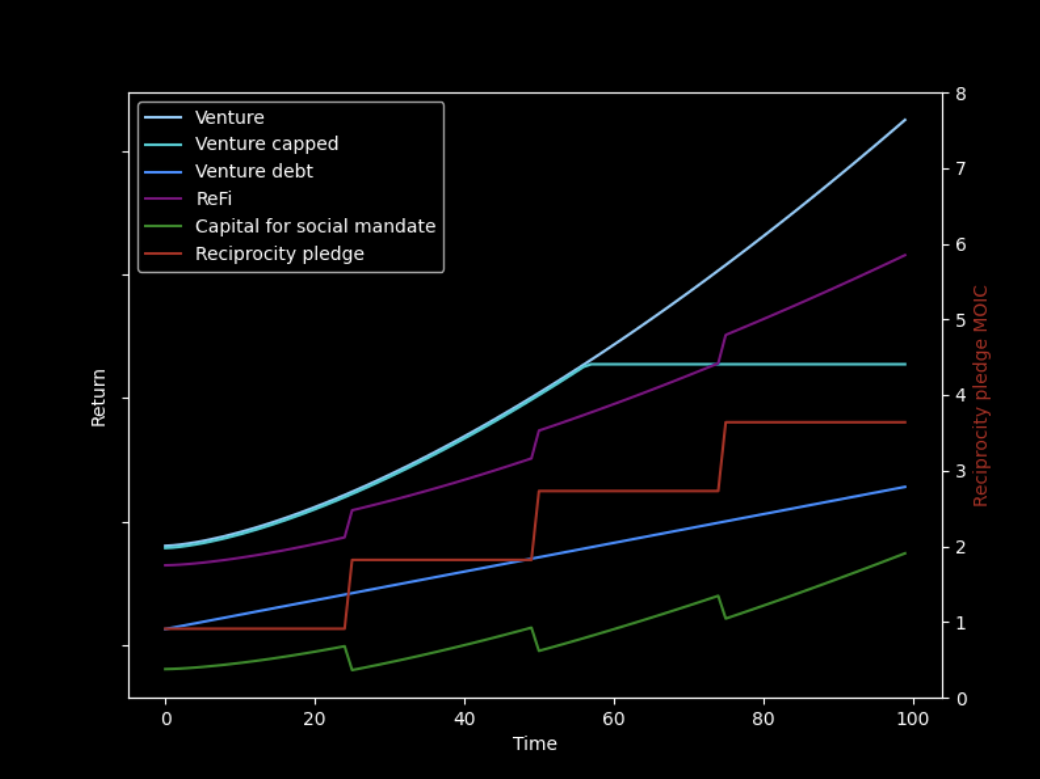

One compelling model is the de-escalating royalty, which was a feature of both the OpenAI-Microsoft deal and MAPS-Vine deal. As investors hit milestones on return profile, the percentage of revenues accruing to investors steps down and more of that cash-flow goes back to social mandates (see figure 1 below). Some interesting features of this model are:

1- Investors are paid back plus a reasonable return before capital is spent on non-profit activities.

2- Investors get to participate in the entire upside of the project. This is superior to capped returns that return investment similar to a debt profile. Since many ambitious projects have considerable risk, investors should have a venture-like return.

3- Investors are paid back off of top-line revenue and not bottom-line profit thereby reducing their risk on the efficiency of the organization.

We see in the above figure that ReFi outperforms capped venture returns or even venture-debt over time because investors get to participate in the entire upside of a given business instead of being capped out. I think this is a superior capital model and generally, I would like to see more experiments in this manner.

Buy & Burn

Another model is where tokens are issued but then profits from the entity are used to buy back the assets and burn them with the intention that over time all investors are bought out and the project can return to fully non-profit mandate once the buy & burn is complete. I would like to sincerely thank Nikolai Mushigan for creating the Buy & Burn model in crypto and writing the code for it in MakerDAO. Nikolai represented crypto-native values in everything he did and was a wonderful innovator and friend. We miss him dearly. One issue with this model is tokens become successively more expensive as you traverse up the bonding curve and thus residual token holders could capture outlier value before the project completes its obligations.

Yield farming on a capital asset to use the cash flow for social activities

The advent of yield-farming in DeFi is a really compelling innovation that enables more capital efficiency, which can be useful for non-profit cultural assets such as art. Here a non-profit with valuable assets assumes debt on the capital asset(s) and then yields with the debt. The resultant spread between yield and debt obligation create a cash-flow that is used for a social mandate. This is a model that would work for art institutions and 1OF1 is actively experimenting with art ReFi to create a sustainable art collection. I think this could be an important mechanism to create greater capital efficiency from valuable cultural assets. I do note that because LTVs would typically be conservative in order to protect the underlying asset, this model implies a longer time-horizon to payback and profitability.

Team reciprocity pledges & ecosystem ReFi support

I call on every token-enabled project with governance on the planet, and frankly every fund and company in crypto to have a reciprocity pledge or fund some ReFi projects in their ecosystem. There has never been an industry on planet earth as profitable as programmable money. Some of the extraordinary returns that these innovations generate should support social projects and we would all do ourselves a favour by propagating more reciprocity in our space.

Growth in ReFi

As the ReFi space continues to evolve, several areas show promise for future experimentation:

Carbon Markets or Biodiversity: Developing more sophisticated on-chain carbon credit systems could revolutionize how we tackle climate change. KlimaDAO and Moss.Earth are interesting experiments in this regard.

Elegant 2-Sided UBI with Slashing: It could be possible to implement slashing mechanisms to drive social influence among communities receiving UBI. For example, if a community is expected to maintain a forest in order to receive UBI, slashing could happen if a subset of the community shirks and illegally logs the forest. Socializing the cost of shirking would be an effective way to have community-policing of social outcomes.

Regenerative DAOs: Forming decentralized autonomous organizations focused specifically on funding and managing a social mandate such as stewarding an important cultural asset is an interesting experiment in its infancy. ConstitutionDAO would have been an interesting large-scale experiment in this regard. I personally think Crypto Punks could potentially be stewarded as a community-driven non-profit DAO that seeks to place Punks into museums globally.

Challenges and Considerations

While ReFi holds significant promise, we should be aware of some pain points and potential challenges:

Measurement and Verification: Ensuring accurate measurement of social impact is crucial for the credibility of ReFi projects.

Regulatory Landscape: As ReFi grows, it will need to navigate complex regulatory environments, especially when dealing with real-world assets and questions around whether associated crypto-assets are securities if they are driving a reasonable return for token holders.

Education and Adoption: Increasing awareness and understanding of ReFi concepts among both crypto enthusiasts and the general public is necessary for more experimentation and adoption.

Starting with Reasonable Payback: For a project to hit escape velocity, investors will have to be paid back and then an interesting social mandate executed on. However, projects can’t forget that the weighted average of cost of capital in crypto is high and capital expects a compelling return in this space, even for social projects.

Corporate Structures: Given the challenges that corporate structures imply in mixing philanthropy with for-profit returns, it makes sense that the eventual solution will come from a DAO or on-chain model.

Predictions Moving Forward

Unfortunately, for the next 24+ months we are probably still stuck in ReFi winter. However, compelling experiments are starting to form now that should produce fruit later this decade. As wealth and capital change in the 2030s with the advent of AGI, I do believe that ReFi will become more prominent as we see incredibly profitable organizations form very quickly and cause philosophical questions among their stakeholders.

I firmly believe that blockchain technologies are an innovation that will deliver positive social impact globally. In order to deliver on the dream of Web3 and the decentralization of power and capital on the internet we must continue to fearlessly experiment with mixing for-profit returns with non-profit social contributions. Fortunately, this space is filled with bold visionaries and we have everything necessary to build an inspiring future for the world.