The Makina Blue Chip Thesis

Introduction

The journey from private crypto investments to accessible, institutional-grade DeFi infrastructure has been long and fragmented. For years, sophisticated yield strategies were only available to accredited investors and had high minimum liquidity requirements. Retail participants settled for basic lending yields of 3-4% on platforms like Aave or much riskier and complex opportunities. Until now, the lack of high quality and accessible onchain strategies has limited DeFi’s long-term growth.

As the first Operator on Makina, Dialectic has witnessed firsthand how this new execution engine bridges that divide. Makina represents the infrastructure layer that will define the next era of professional DeFi asset management. Since the prelaunch phase in late September, we've seen the market validate what we believed from day one: there is massive demand for transparent, professionally-managed onchain strategies that combine institutional rigor with DeFi accessibility. Makina combines sustainable economics, network effects, great strategic positioning, proven market demand, all with a focus on security and transparency.

The Evolution of DeFi Vaults

DeFi is historically plagued by liquidity fragmentation across chains, protocols, liquidity pools etc. For sophisticated players, these inefficiencies create great investment opportunities, due to advantages in opportunity scouting, due diligence and live risk monitoring. Vaults offer a convenient middle layer for end users and institutions alike, enabling access to sophisticated yield strategies without the complexity of manual deployments.

Despite recent volatility and events like the Stream Finance collapse that sparked conversations about transparency, these discussions fail to address fundamental structural limitations. Existing vault products are either passive aggregators held back by lengthy governance processes, lack cross-chain capabilities and require extensive manual integration work.

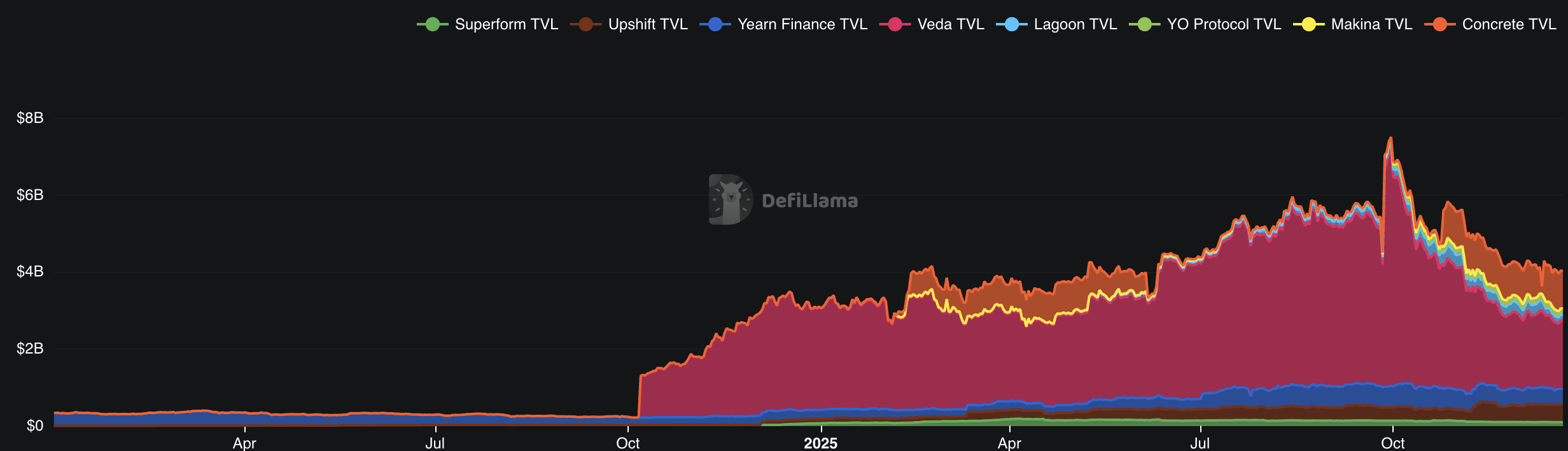

BoringVaults and ERC-4626 that comprise most vault TVL today (figure 1) and incoming ERC-7540 based vaults all address specific pain points but fall short in combining the professional Operator model, cross-chain execution capabilities, institutional risk controls and transparency that the market demands.

Source: DefiLlama.com

The Blue Chip Thesis

Attaining blue chip status in DeFi requires more than temporary success. The vault infrastructure vertical remains nascent—no project has achieved blue chip status yet. Standing amongst industry giants like Aave, MakerDAO or Uniswap requires sustainable economics, network effects, strategic positioning and proven security. We believe Makina is exceptionally well positioned to fulfill all of these demands.

Why Makina's Architecture Matters

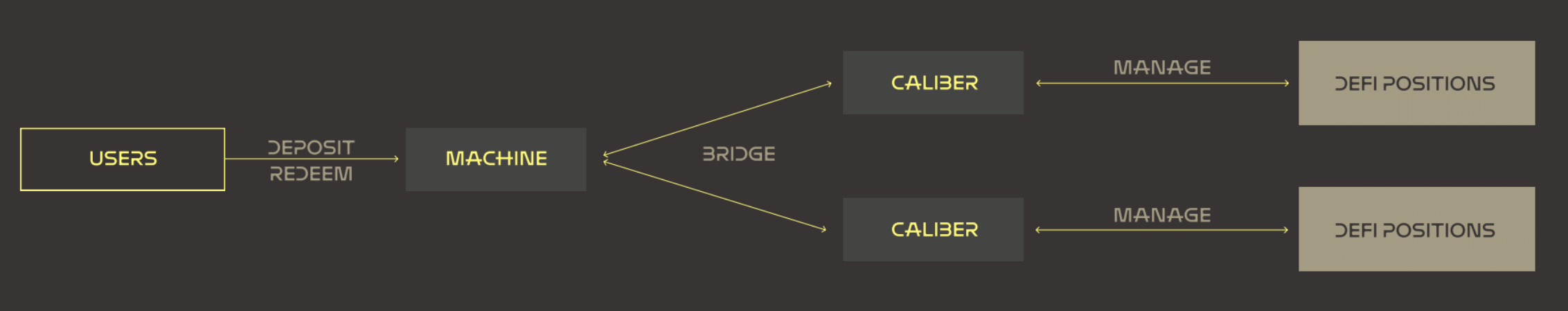

Makina's fundamentally different architecture represents a new approach for vault operations. At its core lies the hub-and-spoke model of a Machine deployed on Ethereum Mainnet as the hub, interacting with Calibers serving as execution environments on Layer 2 chains (figure 2). This design enables transparent unified strategy management across multiple networks, quick deployments on new chains, all without sacrificing security benefits of non-custodial operations.

MakinaVM, the execution environment for strategies, eliminates the need to write custom smart contract adapters for each protocol integration. As cyber•Fund noted in their Makina investment thesis, this approach means "every protocol integration no longer requires new code, new audits, nor does it introduce new attack vectors." Any blueprint to interact with smart contracts that has been created by an Operator is saved in a public repository and usable by all other Operators.

This architectural flexibility extends to risk management. Unlike existing vaults where risk controls are either non-existent or too rigid, Makina enforces onchain risk parameters such as loss thresholds and cooldowns for various operation types, governed by the risk manager. The risk manager pre-approves transaction types, ensuring protocol integrations align with the strategy's mandate. This prevents Operators from taking excessive risks while giving them maximum flexibility to manage strategies effectively.

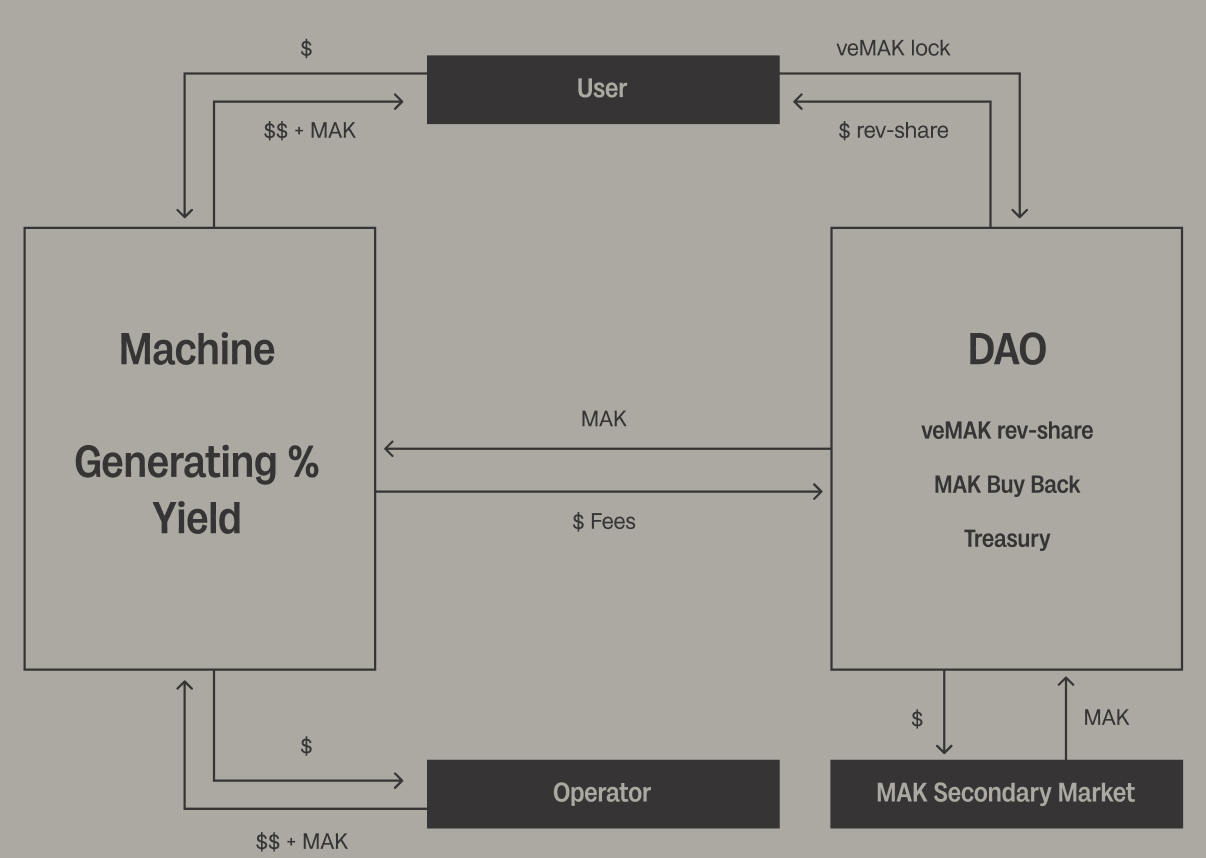

Sustainable Economics

Makina's Operator approach enables professional asset managers to deploy their expertise fully onchain. Value created is distributed among all participants: liquidity providers receive the majority of returns for providing capital, Operators charge management and performance fees aligned with their strategy type, and the Makina DAO receives a share of those fees that accrue to MAK token holders. Strong performance attracts new capital and benefits all involved parties.

Network Effects

As Makina grows and proves its architectural effectiveness, more professional Operators will launch their own Machines. Each additional Operator brings expertise, reputation and capital relationships, increasing Makina's attractiveness for users seeking diverse strategy options tailored to their risk appetite. Machines can be integrated into other applications to expand reach beyond native DeFi users, including (crypto) Neobank apps. In that sense, we believe that the total addressable market (TAM) of Makina is equal to or at least highly correlated with the TAM of onchain asset management. As crypto and traditional finance converge, Makina is poised to be the best execution layer for the future of asset management.

As standard ERC-20 tokens, Machine Tokens are fully composable in DeFi. Dialectic's Machine Tokens DUSD, DETH and DBIT are already integrated on Curve, Pendle, Morpho and Gearbox, with more integrations coming. Operators can freely decide which integrations best align with their strategy. Makina will grow alongside DeFi as the opportunity set expands thanks to the chain-agnostic protocol design of MakinaVM.

Strategic Positioning

Makina occupies the intersection of multiple power trends: institutional DeFi adoption, professional onchain asset management, RWA tokenization, cross-chain execution and transparent onchain operations. This provides multiple paths to sustainable growth and resilience against competitive threats.

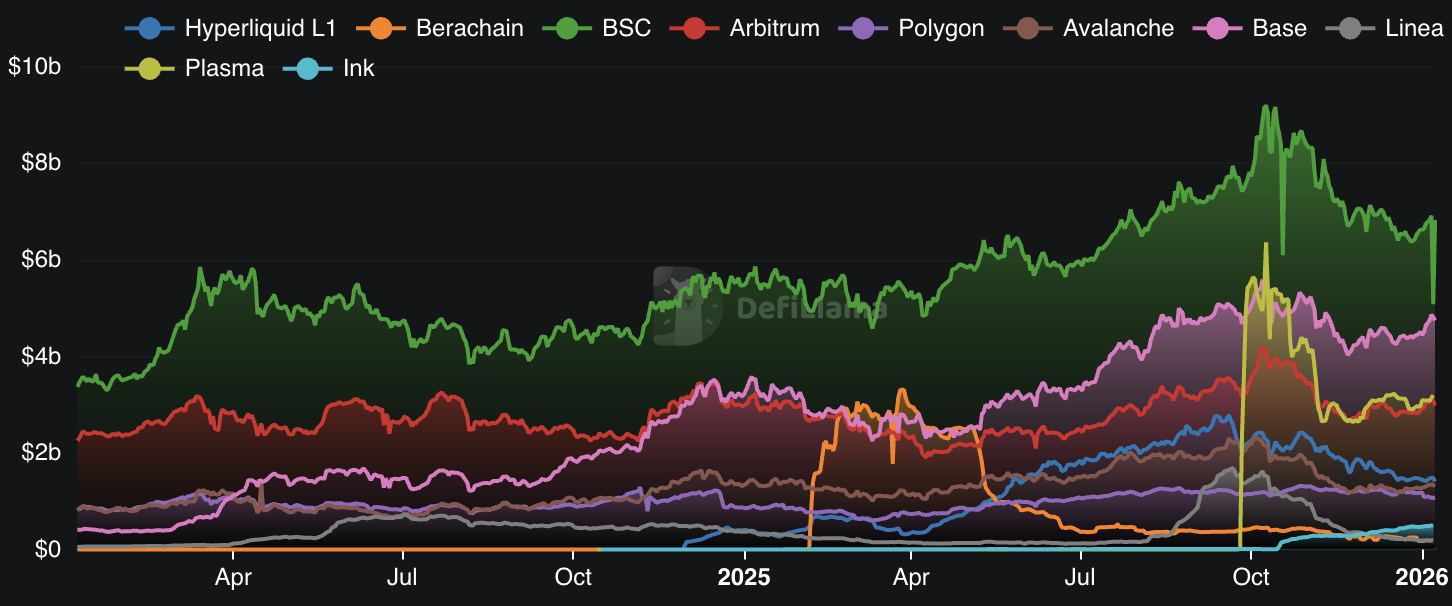

As Operators ourselves, we avoid betting on which chain will dominate and prefer deployment flexibility. Chain TVL fluctuates drastically over time, with new incumbents coming to market regularly (figure 4). Native cross-chain execution provides diversification benefits and ensures Makina is positioned for any eventuality in protocol and chain dominance over time, always positioned to where the best incentives are.

Market Demand

Fueled by the pre-launch campaign, Makina saw rapid TVL growth, surging to $94m in the first week. The protocol showed resilience during market turbulence in late October that saw the broader sector's TVL drop by almost 50%, despite the initial incentive campaign ending around the same time.

Focus on Security

Security itself will be proven over time as Makina achieves more lindy. However, managing assets onchain requires more than bulletproof smart contracts. It extends to the entire package given to Operators and end users: clear investment mandates and adherence to such mandates, onchain accounting, the security module, recovery mode, the security council and atomic execution. We refer to the Makina Docs for further details on any of these aspects.

Conclusion

We believe vaults will be one of the main entry points for users into DeFi, offering use cases ranging from simple savings accounts or high-risk actively managed strategies deployed according to individual risk appetites. Within this context, Makina solves fundamental problems to support the growth of underlying infrastructure to enable such a future.

The case for Makina to evolve into a blue chip protocol rests on five pillars outlined above. From Dialectic's perspective, the question is not whether we should continue growing on Makina, it is how quickly we can scale our existing strategies and create new ones to serve the demand that we know exists. The technology is ready, the capital is waiting and the market is validating the approach. The journey to blue chip status has begun.